Saudi Arabia fifth-largest city in terms of Sovereign Wealth Funds

Saudi Arabia is the world’s fifth-largest city in terms of Sovereign Wealth Funds. Sovereign wealth funds are owned by the general government, including central and sub-national governments, and include investments in foreign financial assets. They invest for financial objectives, excluding public pension funds and central bank reserve assets, which are owned by policyholders.

With US$ 1.7 trillion under management by its Sovereign Wealth Funds (SWFs) as of October 2024, the Emirate of Abu Dhabi is the richest city in the world in terms of capital handled by SWFs, according to data collected and edited by Global SWF.

Following Abu Dhabi are Oslo (home of the world’s largest SWF, NBIM), Beijing (CIC), Singapore (GIC, Temasek), Riyadh (PIF), and Hong Kong (where China’s second SWF, SAFE IC, operates from).

As of October 1, 2024, US$ 12.5 trillion in assets were managed by SWFs; two-thirds of these assets were concentrated in six cities, with Abu Dhabi holding the top rank as the Capital of Capital.

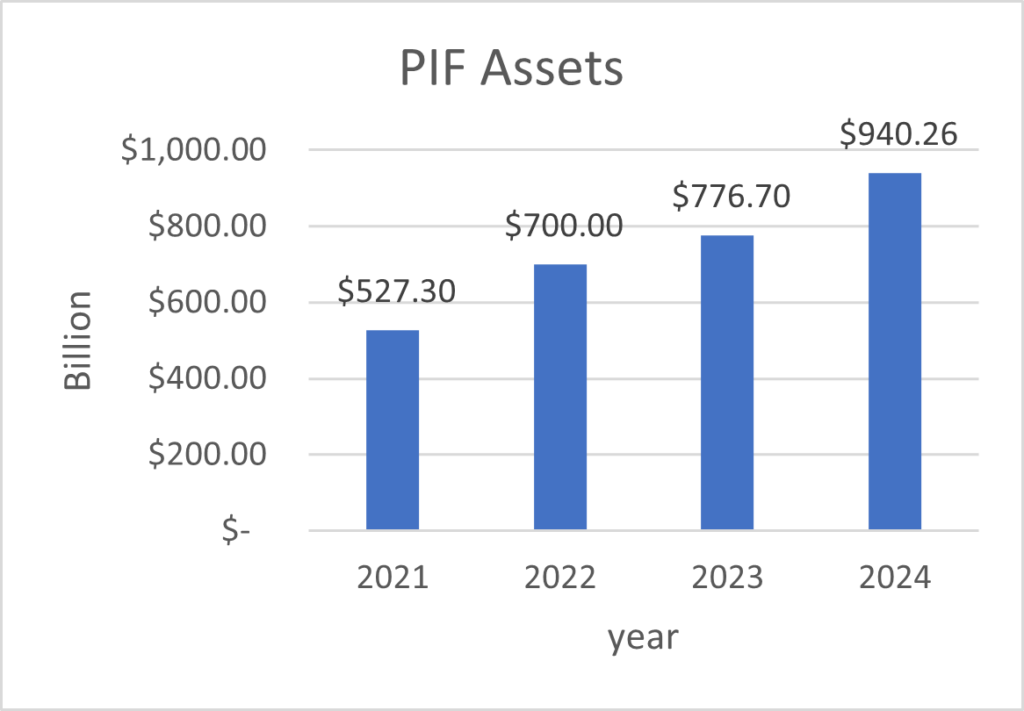

Saudi Arabia’s Public Investment Fund (PIF) has under management $940.26 billion in assets in 2024, up from $527.30 billion in 2021. They have created 1.1 million direct and indirect jobs. They have 95 PIF portfolio companies created across 13 sectors. The PIF invests in several megaprojects, including Neom, Qiddiyah, Red Sea Global, Roshen, and Diriyah Company.

Abu Dhabi leads in terms of human capital, defined as the number of employees working for the SWFs operating under that specific jurisdiction—3,107 employees among the aforementioned funds.

With more than 1,000 workers, Singapore (GIC, Temasek), Riyadh (PIF), Kuala Lumpur (Khazanah, PNB), and Dubai (ICD, DIF) come after Abu Dhabi.

Region-wise, Middle East and North Africa SWFs are top globally with nearly $5.3 trillion in capital, followed by Asia ($4.2 trillion), Europe ($2 trillion), Oceania ($450 billion) and North America ($350 billion).

The worldwide ranking highlights the importance of these financial hubs on the international scene by validating the concentration of sovereign wealth funds in a small number of locations.

Leave a comment